Personal protection

Protect your loved ones and your income

Would you like to protect your family in the event of death or disability?

With protect4life, Foyer offers you a personal protection insurance solution that adapts to your family and professional situation, while reducing your tax bill.

family and my income

Protect4life

A flexible solution that adapts to the rhythm of your life

protect4life is a personal protection-savings policy with periodic premiums and a minimum 10-year term. Depending on your needs, you can:

- ensure a lump sum will be paid out to the beneficiary of your choice in the event of your death,

- ensure an annuity for your children,

- protect your income in the event of disability,

- build up savings,

- grow your capital.

protect4life is accessible from €25 per month.

What are your needs?

You don’t have to choose between protecting your loved ones, your income or building up savings.

Foyer offers you a solution that combines protection and savings while adapting to your needs.

Your main benefits

You have a choice of cover in the event of death:

A lump sum paid to the beneficiary(ies) at the time of death.

A lump sum paid out at the end of the policy on an agreed date (deferred lump sum) to help provide for your children’s higher education.

A lump sum or annuity paid up to your children’s 27th birthday to provide for their daily needs.

Your optional cover

A disability pension to protect your income.

Useful cover if, for example, you are self-employed, a new arrival or just starting out in your professional life.

Gradual savings to finance your future plans.

Useful cover if you want to build up capital while benefiting from stock market returns.

You wish to optimise your taxation?

- Under the terms of article 111 of the Income Tax Law, you can deduct premiums paid into a life insurance policy and additional cover premiums from your income taxes.

- Savings-personal protection : You can deduct up to €672 a year per member of your household.

Our SOLUTIONS

The choice of different investment vehicles to allocate your savings

1 capital protection option to provide balance between growth and security.

(Within the limit of 50% of your investments)

6 variable capital investment vehicles that offer greater performance, including 2 ESG vehicles to give meaning to your investments by adopting a responsible approach.

Access to different unit-linked investment vehicles

To benefit from interesting yield prospects, you also have access to different funds.

They enable you to invest according to your investment horizon and your risk profile.

| Currency | Date | NAV | YTD | 1 year | 3 years | 5 years | ||

|---|---|---|---|---|---|---|---|---|

| ESG Bonds at Work | CurrencyEUR | Date05/03/2026 | NAV156.91 | YTD1.65 % | 1 year1.4 % | 3 years2.04 % | 5 years0.4 % | Download details |

| ESG Equities at Work | CurrencyEUR | Date05/03/2026 | NAV265.3 | YTD1.31 % | 1 year11.41 % | 3 years11.26 % | 5 years9.33 % | Download details |

| Contrarian | CurrencyEUR | Date05/03/2026 | NAV1270 | YTD1.67 % | 1 year8.07 % | 3 years9.73 % | 5 years8.03 % | Download details |

| Defensive | CurrencyEUR | Date05/03/2026 | NAV210.51 | YTD1.87 % | 1 year3.65 % | 3 years3.93 % | 5 years2.49 % | Download details |

| Balanced | CurrencyEUR | Date05/03/2026 | NAV231.42 | YTD2.02 % | 1 year5.48 % | 3 years6.22 % | 5 years4.74 % | Download details |

| Dynamic | CurrencyEUR | Date05/03/2026 | NAV295.9 | YTD2.16 % | 1 year7.66 % | 3 years8.74 % | 5 years6.98 % | Download details |

Annualized return in %

Key features protect4life

|

Protection for your loved ones

In the event of death or disability, you or your loved ones benefit from the amount set when you took out the policy.

|

|---|

|

Flexibility

You can modify the cover to suit your needs and situation.

|

|

Savings not taxed on exit

Both the benefit payable on policy maturity and the death benefit are tax free.

|

|

Attractive potential returns

You have access to a range of funds that allow you to benefit from stock market performance.

|

|

Responsible management

The management of your savings is ensured by a team of experienced CapitalatWork managers. They aim to strike the right balance between risk and yields so as to profit from performance on the financial markets.

|

Completing your Luxembourg tax return: hints and tips

Most Luxembourg citizens and cross-border workers must complete a tax declaration in Luxembourg every year. The declaration gives you the opportunity to deduct various expenses and so reduce the amount…

Read more : Completing your Luxembourg tax return: hints and tipsHow can you ensure you are well prepared for your retirement?

What will your income be once you’ve retired? Not many people can answer this question, but it’s an important one. Retirement can be a good and long period of your…

Read more : How can you ensure you are well prepared for your retirement?Your tax return, simpler than ever with Foyer and taxx.lu

Filing your tax return in Luxembourg can quickly become a headache: complex forms, changing rules, documents to gather… And yet, a well-prepared return can help you optimise your situation and…

Read more : Your tax return, simpler than ever with Foyer and taxx.luFind all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

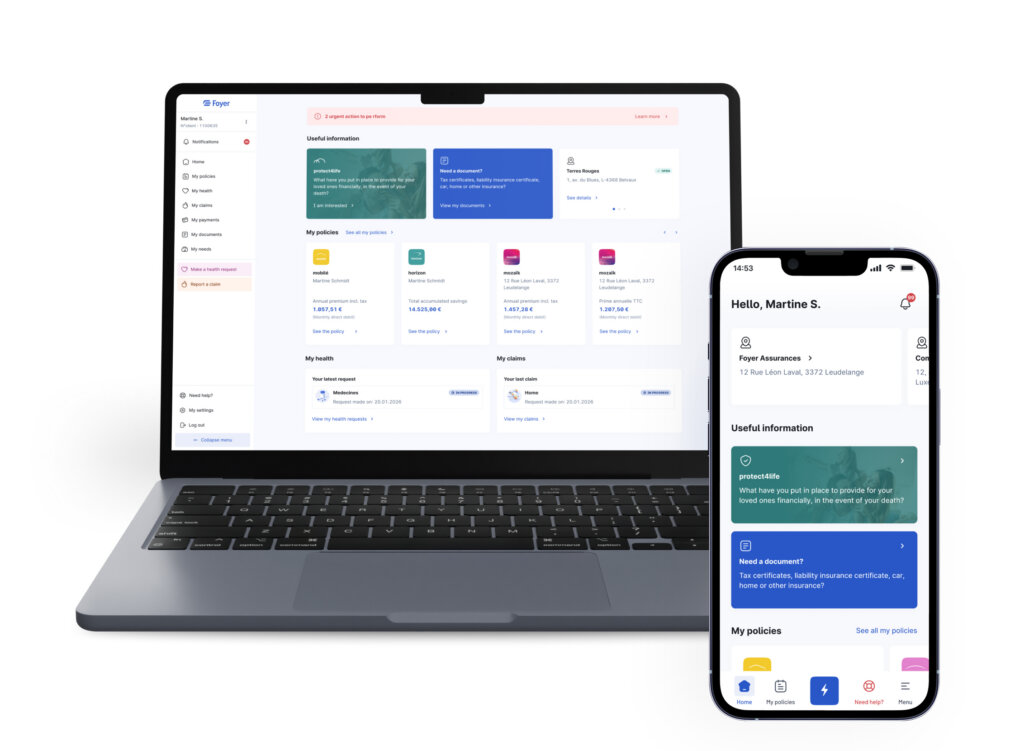

MYFOYER APP

Simple and intuitive, MyFoyer makes your online procedures easier

Submit your health and claims requests online

Save time and complete your procedures in your Client Area.

Sign your documents remotely

You can sign your contracts and direct debit authorisations from home.

Real-time tracking

No more waiting around, you can keep track of the progress of your files.

Access your documents

View and download all your important documents.

Manage your profile

Update your personal data yourself.

View and pay your invoices

View and pay your invoices online.

Contact me

Contact our experts and we will provide you with a quick response.