Tax optimisation

Protect your future and reduce your taxes

Foyer’s savings and investment life insurance plans help you build savings for the future, facilitate the transfer of your wealth and protect your loved ones; all this while optimising your taxes.

my tax

myTax, your digital tax assistant

Thanks to Vireo’s myTax tool, file your tax return in your Client Area and discover savings solutions to optimise your taxable income.

Our SOLUTIONS

Discover our solutions for optimizing your tax return

Retirement savings solutions

Upon retirement, the amount of your statutory pension will be seriously reduced compared to the amount of your last income. With retirement savings insurance solutions, you can close this gap.

horizon

Flexible supplementary pension scheme linked to a range of investment funds . You are free to choose the frequency and the amount of premiums paid. When the policy matures, you may choose to have the capital in the form of a single payment or a monthly lifetime annuity.

Up to 3200€ tax deductible (Article 111 bis of Luxembourg Income Tax Law)

Conditions :

- The minimum contract term is 10 years.

- The contract maturity age is minimum 60 years and maximum 75 years.

protect4life

A solution that allows you to anticipate your financial future and that of your loved ones with peace of mind by combining life insurance and savings to suit all your needs.

protect4life grows with you, giving you the chance to personalise your cover to suit your family and professional situation.

Up to 672€ tax deductible (Article 111 of Luxembourg Income Tax Law)

The personal protection solution

In addition to projects like home renovation or going on a long trip, do you want to protect your loved ones and your income and save gradually? Our personal protection solution meets these needs and will even allow you to save on taxes.

Life insurance

As part of a financial loan, life insurance enables you to secure a debt and protect your loved ones in times of need. According to the chosen solution, you guarantee your loved ones a stable financial future.

focus financement

focus financement covers the outstanding amount (TSRD) of your loan in the event of death. The balance of your loan is paid to your bank and your debt is paid off.

focus investissement

Have you found your future home? Our focus investissement loan balance policy (TSRD) covers mortgage loans and long-term investments to buy or build your family home.

In the case of payment in a single premium, the annual deductible increases according to your age.

Up to 672€ tax deductible (Article 111 of Luxembourg Income Tax Law)

wüstenrot

Created in 1921, Wüstenrot Bausparkasse AG is the oldest and one of the largest building societies in Germany. Its Luxembourg branch, located in Munsbach, deals with all home purchase savings requests from Foyer customers.

Up to €672 tax deductible per household member (article 111 of the L.I.R.). For taxpayers aged between 18 and 40, the ceiling is doubled to €1,344 per household member.

Homebuyer savings plans

By combining home savings with your mortgage, you can finance your home or build up savings while enjoying tax benefits. Thanks to the home savings solutions offered by our partner Wüstenrot, you can deduct the contributions paid into your contract from your taxable income.

Other tax deductible products

- The premiums for third-party liability (for motor vehicle, home, private insurance). In the premium amount of your mobilé insurance, the premiums for cover for equipment damage, fire, theft, glass damage or legal cover are not deductible. However, the amount of the protected driver cover is deductible.

- The contribution to your medicis extended healthcare cover is also deductible.

Up to 672€ tax deductible per household member (Article 111 of Luxembourg Income Tax Law)

Investment solutions using ESG funds: responsible savings that reflect your values

Foyer offers investment solutions using ESG (Environment, Social, and Governance) funds so you can build a nest egg while respecting your values. Invest in funds that factor in environmental issues,…

Read more : Investment solutions using ESG funds: responsible savings that reflect your valuesInvest in your plans

Do you have lots of ideas for the future? Do you dream of buying a country house, sailing around the world, building a veranda or helping your children or grandchildren…

Read more : Invest in your plansInsurance premiums that can be deducted when you file your Luxembourg tax return

Luxembourg’s tax system offers ways to reduce your income tax liability thanks to deductible insurance premiums. Article 111bis of the individual tax allowances (ITA)[1] allows you to deduct up to…

Read more : Insurance premiums that can be deducted when you file your Luxembourg tax returnFind all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

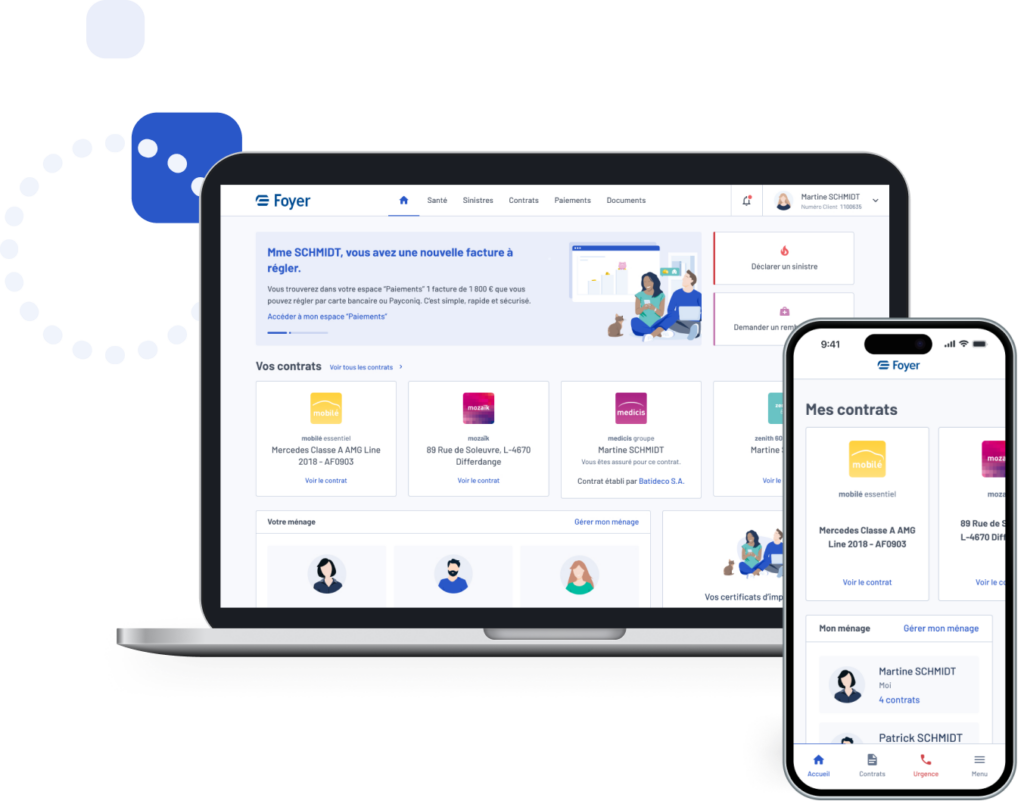

MyFoyer Client Area

In your MyFoyer client area, you can view your contracts, request a tax certificate or update your personal details.

Contact me

Contact our experts and we will provide you with a quick response.