Investment

Grow your capital

You are looking to diversify your savings by taking advantage of stock market returns while optimising your estate planning.

my savings

Our SOLUTIONS

2 Investment solutions that can adapt to your pace and your projects

invest4change

You want to give more meaning your investments by contributing to a more responsible, ecological and social future?

invest4change is a multi-vehicle life insurance contract that you can pay into and withdraw from as you wish through which you can invest, over the medium to long terms, in ethical investment funds that apply a method of securities selection (equities or bonds) integrating ESG (Environmental, Social and Governance) criteria. You can divide your investments between two funds according to your investor profile. From conservative to aggressive, you have the choice of 4 profiles depending on your personal situation, your objectives and your needs.

Conservative profile

Capital protection

- 25% ESG Equities

- 75% ESG Bonds

Balanced profile

A balance between growth and security

- 50% ESG Equities

- 50% ESG Bonds

Growth profile

Attractive yield prospects

- 75% ESG Equities

- 25% ESG Bonds

Aggressive profile

Long-term growth

- 100% ESG Equities

A socially responsible investment strategy

- The integration of ESG (Environmental, Social and Governance) criteria during the investment process.

- Transparency of our investments through regular dialogue with our clients.

- Our commitment to represent your best interests through our investments.

smartlife

You would like to set aside capital and have it grow in order to finance future projects?

smartlife is a multi-vehicle life insurance policy that you can pay into and withdraw from as you wish and consisting of 4 packages. Investments can be allocated between the unit-linked accounts and a vehicle with a guaranteed rate providing significant flexibility.

SMARTLIFE 25

Capital protection

- 25% unit-linked funds

- 75% at a guaranteed rate

SMARTLIFE 50

A balance between growth and security

- 50% unit-linked funds

- 50% at a guaranteed rate

SMARTLIFE 75

Attractive yield prospects

- 75% unit-linked funds

- 25% at a guaranteed rate

SMARTLIFE 100

Long-term growth

- 100% unit-linked funds

Access to different unit-linked investment vehicles

To benefit from interesting yield prospects, you also have access to different funds.

They enable you to invest according to your investment horizon and your risk profile.

| INVEST4CHANGE | Currency | Date | NAV | YTD | 1 year | 3 years | 5 years | |

|---|---|---|---|---|---|---|---|---|

| ESG Bonds at Work | CurrencyEUR | Date16/07/2025 | NAV153.41 | YTD-0.9 % | 1 year0.27 % | 3 years-0.41 % | 5 years-0.17 % | Download details |

| ESG Equities at Work | CurrencyEUR | Date16/07/2025 | NAV241.97 | YTD4.61 % | 1 year4.71 % | 3 years11.05 % | 5 years10.81 % | Download details |

Annualized return in %

| SMARTLIFE | Currency | Date | NAV | YTD | 1 year | 3 years | 5 years | |

|---|---|---|---|---|---|---|---|---|

| ESG Equities at Work | CurrencyEUR | Date16/07/2025 | NAV241.97 | YTD4.61 % | 1 year4.71 % | 3 years11.05 % | 5 years10.81 % | Download details |

| Balanced | CurrencyEUR | Date16/07/2025 | NAV216.36 | YTD-0.37 % | 1 year1.53 % | 3 years4.38 % | 5 years5.12 % | Download details |

| Dynamic | CurrencyEUR | Date16/07/2025 | NAV271.12 | YTD0.39 % | 1 year2.99 % | 3 years7.29 % | 5 years7.9 % | Download details |

| Contrarian | CurrencyEUR | Date16/07/2025 | NAV1150.70 | YTD0.01 % | 1 year2.69 % | 3 years9.28 % | 5 years9.71 % | Download details |

Annualized return in %

Key features

|

Invest4change

|

Smartlife

|

|

|---|---|---|

|

Aligned with your values

Socially responsible investment (SRI), through invest4change you invest with awareness to protect the world in which we live.

|

||

|

Product awarded

A product with a label that is based on an investment strategy strictly approved by professional associations specialising in this area.

|

||

|

Estate planning

You are free to appoint the beneficiaries of your policy in the event of death, a choice you can amend at any time free of charge.

|

||

|

Attractive potential returns

Depending on your investment horizon, smartlife and invest4change offer you many opportunities to grow your savings through its different investment funds (possibility to choose ESG funds) or its guaranteed-rate vehicle.

|

||

|

Your money remains available

You can withdraw all or part of your savings at any time free of charge.

|

||

|

Flexibility

You can switch between funds if you want to change the allocation of your investments.

|

||

|

No exit tax on your savings

Your capital payable when the policy matures or in the event of a partial or total exit is tax exempt.

|

||

|

Responsible management

The management of your savings is ensured by CapitalatWork, a team of experienced asset managers. They aim to strike the right balance between risk and yields so as to profit from performance on the financial markets.

|

||

|

Optimum protection of your savings

Luxembourg life insurance policies provide unlimited security on the deposited assets. The capital of your policy is separated from the assets of the insurance company and the custodian bank. This “super-privilege” enables you to recover your assets ahead of any other creditor of the company.

|

Included

Not included

Investment solutions using ESG funds: responsible savings that reflect your values

Foyer offers investment solutions using ESG (Environment, Social, and Governance) funds so you can build a nest egg while respecting your values. Invest in funds that factor in environmental issues,…

Read more : Investment solutions using ESG funds: responsible savings that reflect your valuesInvest in your plans

Do you have lots of ideas for the future? Do you dream of buying a country house, sailing around the world, building a veranda or helping your children or grandchildren…

Read more : Invest in your plansInsurance premiums that can be deducted when you file your Luxembourg tax return

Luxembourg’s tax system offers ways to reduce your income tax liability thanks to deductible insurance premiums. Article 111bis of the individual tax allowances (ITA)[1] allows you to deduct up to…

Read more : Insurance premiums that can be deducted when you file your Luxembourg tax returnFind all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

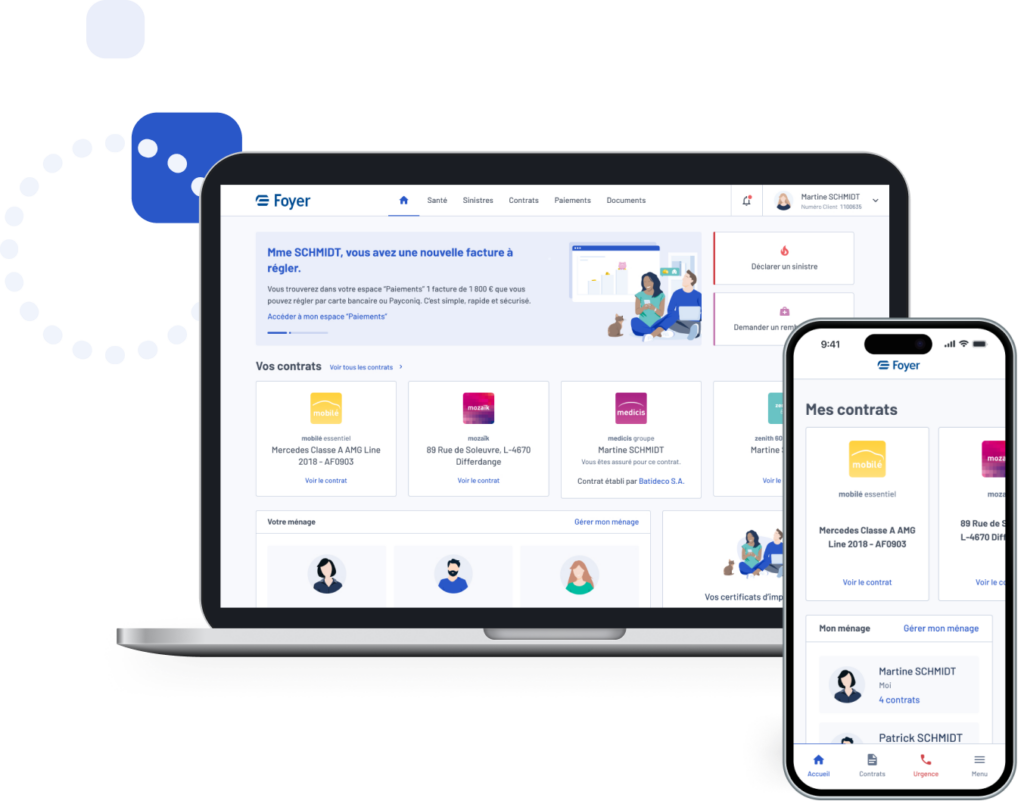

MyFoyer Client Area

In your MyFoyer client area, you can view your contracts, request a tax certificate or update your personal details.

Contact me

Contact our experts and we will provide you with a quick response.