Outstanding balance insurance

Mortgage life insurance policies

Our mortgage/loan life insurance policies (TSRD) focus investissement provides life coverage to cover the capital amount borrowed for investments, typically mortgage loans and long-term investments related to purchasing business premises or when buying or building a home.

the unexpected

Cover you can adapt to fit your needs

In the event of death

With a TSRD policy, we’ll pay back the balance of your mortgage to ensure your loved ones are not left with a heavy financial burden.

In the event of disability

The policyholder becomes eligible to receive the payout that is available at that given time should they become totally and permanently disabled.

Key features

Protection for your loved ones in the event of death or disability

By insuring your mortgage, you’re protecting your loved ones from financial hardship.

Tax optimisation

Insurance premiums for TSRD loan balance policies are income-tax deductible up to €672 per year, or double if you are married/for each additional child.

Bis zu 672 € jährlich zusätzlich für jede weitere Person im selben Haushalt.

| Taxpayer | Single | With spouse |

|---|---|---|

| Without children | €672 | €1,344 |

| Per additional child | +€672 | +€672 |

If you pay a single premium, the annual deductible limit increases depending on your age and the number of children you have.

| Taxpayer | Up to 30 years | Single | With spouse |

|---|---|---|---|

| Without children | €6,000 | +€480 / year | €15,600 |

| Per additional child | +€1,200 | +€96 / year | +€3,120 |

Right to be forgotten

At the end of 2019, Foyer Assurances signed the convention on the “right to be forgotten”, which entered into force on 1 January 2020.

This convention aims to facilitate access to loan balance policies for at-risk individuals with cancer and under certain conditions.

Portable heaters: beware of fire!

Portable heaters are very effective at quickly heating up a room and are very useful in a bathroom, guest room or office, especially when working from home. Whether it’s electric,…

Read more : Portable heaters: beware of fire!Expats: plan your trips with peace of mind with the right insurance

Whether you are visiting loved ones, discovering a new destination or simply taking a break, it is essential to prepare your trips well. And that includes taking out the right…

Read more : Expats: plan your trips with peace of mind with the right insuranceTips for a cosy and safe Christmas

Christmas is approaching and all the decorations have been brought up from the cellar and down from the attic. Christmas trees, mantels and window sills are probably covered with glitter…

Read more : Tips for a cosy and safe ChristmasFind all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

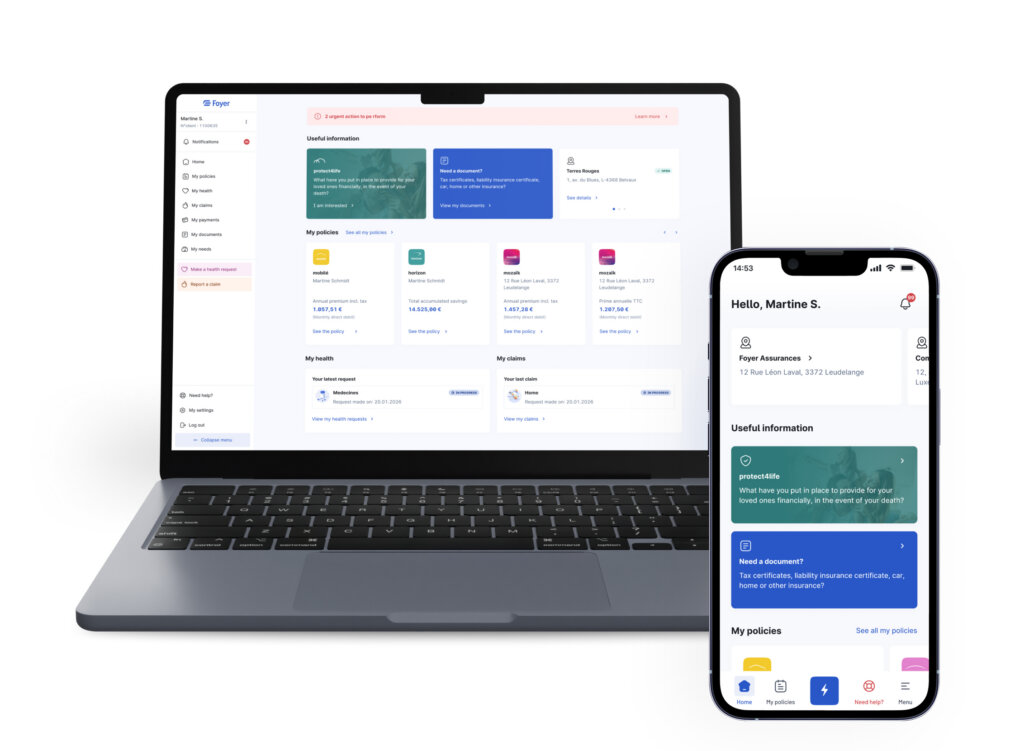

MYFOYER APP

Simple and intuitive, MyFoyer makes your online procedures easier

Submit your health and claims requests online

Save time and complete your procedures in your Client Area.

Sign your documents remotely

You can sign your contracts and direct debit authorisations from home.

Real-time tracking

No more waiting around, you can keep track of the progress of your files.

Access your documents

View and download all your important documents.

Manage your profile

Update your personal data yourself.

View and pay your invoices

View and pay your invoices online.

Contact me

Contact our experts and we will provide you with a quick response.