Investment

Grow your capital

You are looking to diversify your savings by taking advantage of stock market returns while optimising your estate planning.

my savings

smartlife

Our investment solutions adapts to your pace and your plans

smartlife

You would like to set aside capital and have it grow in order to finance future projects?

smartlife is a multi-vehicle life insurance policy that you can pay into and withdraw from as you wish and consisting of 4 packages. Investments can be allocated between the unit-linked accounts and a vehicle with a guaranteed rate providing significant flexibility.

SMARTLIFE 25

Capital protection

- 25% unit-linked funds

- 75% at a guaranteed rate

SMARTLIFE 50

A balance between growth and security

- 50% unit-linked funds

- 50% at a guaranteed rate

SMARTLIFE 75

Attractive yield prospects

- 75% unit-linked funds

- 25% at a guaranteed rate

SMARTLIFE 100

Long-term growth

- 100% unit-linked funds

A socially responsible investment strategy

- The integration of ESG (Environmental, Social and Governance) criteria during the investment process.

- Transparency of our investments through regular dialogue with our clients.

- Our commitment to represent your best interests through our investments.

Access to different unit-linked investment vehicles

To benefit from interesting yield prospects, you also have access to different funds.

They enable you to invest according to your investment horizon and your risk profile.

| SMARTLIFE | Currency | Date | NAV | YTD | 1 year | 3 years | 5 years | |

|---|---|---|---|---|---|---|---|---|

| ESG Equities at Work | CurrencyEUR | Date24/02/2026 | NAV269.71 | YTD2.99 % | 1 year10.63 % | 3 years12.47 % | 5 years9.46 % | Download details |

| ESG Bonds at Work | CurrencyEUR | Date24/02/2026 | NAV157.06 | YTD1.75 % | 1 year0.41 % | 3 years2.08 % | 5 years0.41 % | Download details |

| Defensive | CurrencyEUR | Date24/02/2026 | NAV211.44 | YTD2.32 % | 1 year2.68 % | 3 years4.23 % | 5 years2.55 % | Download details |

| Balanced | CurrencyEUR | Date24/02/2026 | NAV233.39 | YTD2.89 % | 1 year4.6 % | 3 years6.83 % | 5 years4.91 % | Download details |

| Dynamic | CurrencyEUR | Date24/02/2026 | NAV299.61 | YTD3.45 % | 1 year6.93 % | 3 years9.68 % | 5 years7.23 % | Download details |

| Contrarian | CurrencyEUR | Date24/02/2026 | NAV1285.32 | YTD2.9 % | 1 year6.92 % | 3 years10.85 % | 5 years8.28 % | Download details |

Annualized return in %

Key features

|

Aligned with your values

Do you want to give meaning to your investments? smartlife allows you to invest in ethical investment funds that follow an asset selection methodology (shares or bonds) incorporating ESG (Environmental, Social and Governance) criteria.

|

|---|

|

Estate planning

You are free to appoint the beneficiaries of your policy in the event of death, a choice you can amend at any time free of charge.

|

|

Attractive potential returns

Depending on your investment horizon, smartlife and invest4change offer you many opportunities to grow your savings through its different investment funds (possibility to choose ESG funds) or its guaranteed-rate vehicle.

|

|

Your money remains available

You can withdraw all or part of your savings at any time free of charge.

|

|

Flexibility

You can switch between funds if you want to change the allocation of your investments.

|

|

No exit tax on your savings

Your capital payable when the policy matures or in the event of a partial or total exit is tax exempt.

|

|

Responsible management

The management of your savings is ensured by CapitalatWork, a team of experienced asset managers. They aim to strike the right balance between risk and yields so as to profit from performance on the financial markets.

|

|

Optimum protection of your savings

Luxembourg life insurance policies provide unlimited security on the deposited assets. The capital of your policy is separated from the assets of the insurance company and the custodian bank. This “super-privilege” enables you to recover your assets ahead of any other creditor of the company.

|

How can you ensure you are well prepared for your retirement?

What will your income be once you’ve retired? Not many people can answer this question, but it’s an important one. Retirement can be a good and long period of your…

Read more : How can you ensure you are well prepared for your retirement?Your tax return, simpler than ever with Foyer and taxx.lu

Filing your tax return in Luxembourg can quickly become a headache: complex forms, changing rules, documents to gather… And yet, a well-prepared return can help you optimise your situation and…

Read more : Your tax return, simpler than ever with Foyer and taxx.luPension reform in Luxembourg: What key changes are in store for 2026

Retirement planning in Luxembourg is a serious subject for everyone, whether you’re a resident or a cross-border worker…just like many countries, Luxembourg is facing demographic changes to its aging population. In order…

Read more : Pension reform in Luxembourg: What key changes are in store for 2026Find all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

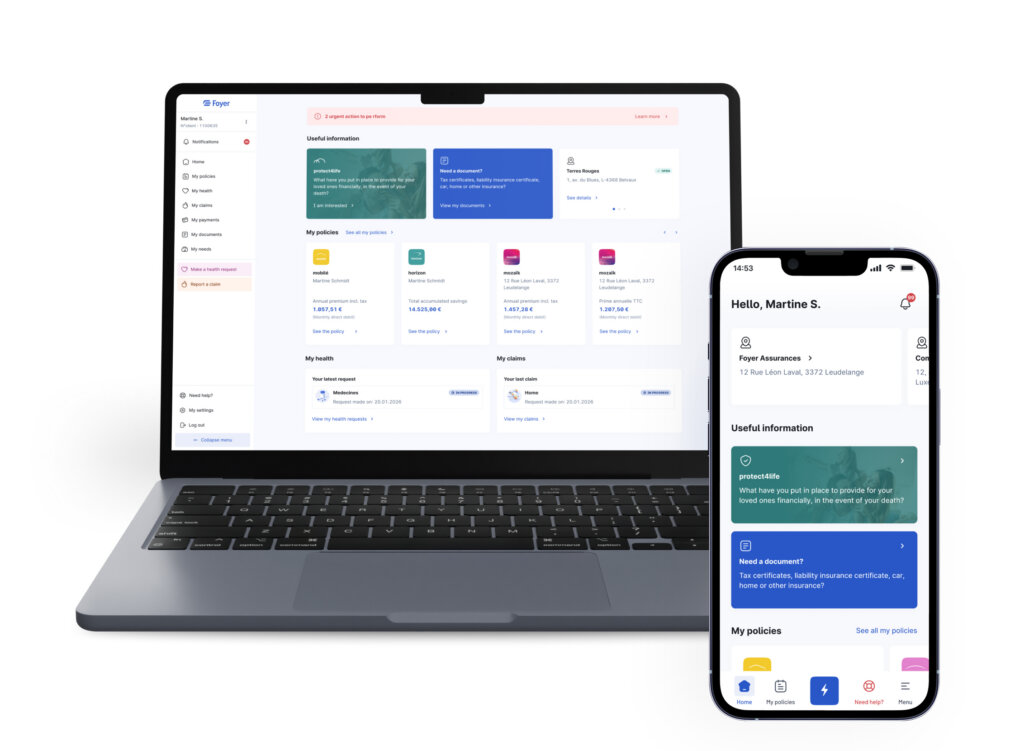

MYFOYER APP

Simple and intuitive, MyFoyer makes your online procedures easier

Submit your health and claims requests online

Save time and complete your procedures in your Client Area.

Sign your documents remotely

You can sign your contracts and direct debit authorisations from home.

Real-time tracking

No more waiting around, you can keep track of the progress of your files.

Access your documents

View and download all your important documents.

Manage your profile

Update your personal data yourself.

View and pay your invoices

View and pay your invoices online.

Contact me

Contact our experts and we will provide you with a quick response.