Tax optimisation

Protect your future and reduce your taxes

Foyer’s savings and investment life insurance plans help you build savings for the future, facilitate the transfer of your wealth and protect your loved ones; all this while optimising your taxes.

my tax

Calculate your tax benefit now!

Use our simulator to find out the maximum deductible amount and the impact on your taxes.

Simple, quick and free.

Our SOLUTIONS

Discover our solutions for optimizing your tax return

Retirement savings solutions

Upon retirement, the amount of your statutory pension will be seriously reduced compared to the amount of your last income. With retirement savings insurance solutions, you can close this gap.

horizon

Flexible supplementary pension scheme linked to a range of investment funds . You are free to choose the frequency and the amount of premiums paid. When the policy matures, you may choose to have the capital in the form of a single payment or a monthly lifetime annuity.

Up to 4,500€ tax deductible (Article 111 bis of Luxembourg Income Tax Law)

Conditions :

- The minimum contract term is 10 years.

- The contract maturity age is minimum 60 years and maximum 75 years.

protect4life

A solution that allows you to anticipate your financial future and that of your loved ones with peace of mind by combining life insurance and savings to suit all your needs.

protect4life grows with you, giving you the chance to personalise your cover to suit your family and professional situation.

Up to 672€ tax deductible (Article 111 of Luxembourg Income Tax Law)

The personal protection solution

In addition to projects like home renovation or going on a long trip, do you want to protect your loved ones and your income and save gradually? Our personal protection solution meets these needs and will even allow you to save on taxes.

Life insurance

As part of a financial loan, life insurance enables you to secure a debt and protect your loved ones in times of need. According to the chosen solution, you guarantee your loved ones a stable financial future.

focus financement

focus financement covers the outstanding amount (TSRD) of your loan in the event of death. The balance of your loan is paid to your bank and your debt is paid off.

focus investissement

Have you found your future home? Our focus investissement loan balance policy (TSRD) covers mortgage loans and long-term investments to buy or build your family home.

In the case of payment in a single premium, the annual deductible increases according to your age.

Up to 672€ tax deductible (Article 111 of Luxembourg Income Tax Law)

wüstenrot

Created in 1921, Wüstenrot Bausparkasse AG is the oldest and one of the largest building societies in Germany. Its Luxembourg branch, located in Munsbach, deals with all home purchase savings requests from Foyer customers.

Up to €672 tax deductible per household member (article 111 of the L.I.R.). For taxpayers aged between 18 and 40, the ceiling is doubled to €1,344 per household member.

Homebuyer savings plans

By combining home savings with your mortgage, you can finance your home or build up savings while enjoying tax benefits. Thanks to the home savings solutions offered by our partner Wüstenrot, you can deduct the contributions paid into your contract from your taxable income.

Other tax deductible products

- The premiums for third-party liability (for motor vehicle, home, private insurance). In the premium amount of your mobilé insurance, the premiums for cover for equipment damage, fire, theft, glass damage or legal cover are not deductible. However, the amount of the protected driver cover is deductible.

- The contribution to your medicis extended healthcare cover is also deductible.

Up to 672€ tax deductible per household member (Article 111 of Luxembourg Income Tax Law)

Your tax return, simpler than ever with Foyer and taxx.lu

Filing your tax return in Luxembourg can quickly become a headache: complex forms, changing rules, documents to gather… And yet, a well-prepared return can help you optimise your situation and…

Read more : Your tax return, simpler than ever with Foyer and taxx.luPension reform in Luxembourg: What key changes are in store for 2026

Retirement planning in Luxembourg is a serious subject for everyone, whether you’re a resident or a cross-border worker…just like many countries, Luxembourg is facing demographic changes to its aging population. In order…

Read more : Pension reform in Luxembourg: What key changes are in store for 2026It’s more important than ever for young people to think about retirement planning

Why? Due to our increasing life expectancy many of us will have a much longer retirement period than previous generations. Living until you’re 90 now means you’ll be living on…

Read more : It’s more important than ever for young people to think about retirement planningFind all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

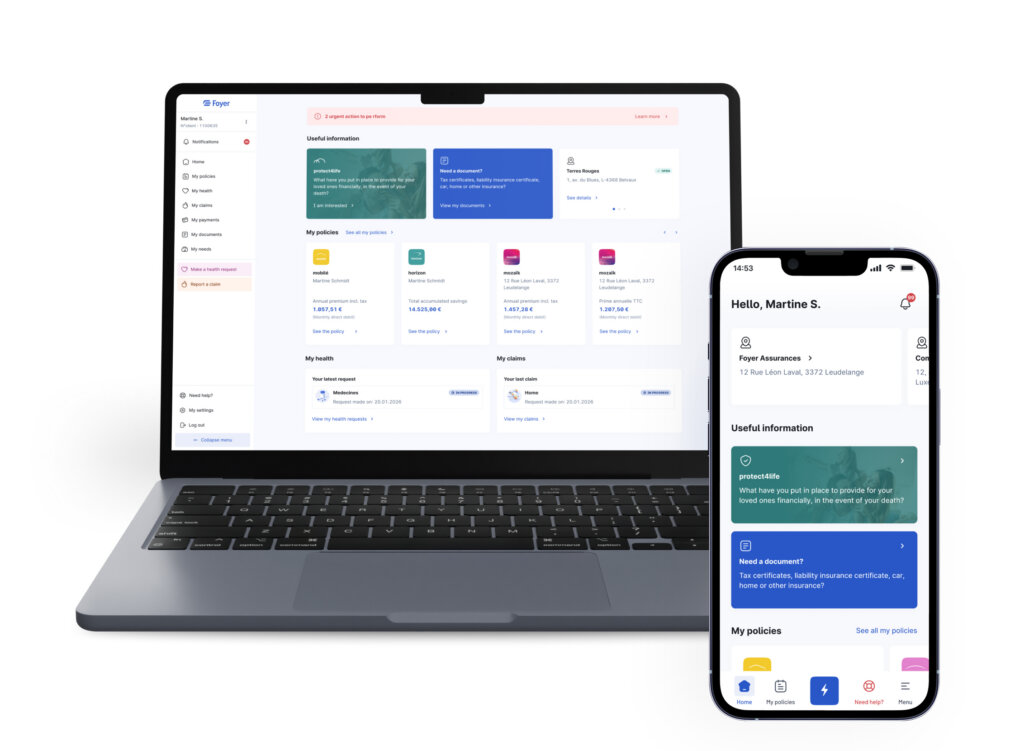

MYFOYER APP

Simple and intuitive, MyFoyer makes your online procedures easier

Submit your health and claims requests online

Save time and complete your procedures in your Client Area.

Sign your documents remotely

You can sign your contracts and direct debit authorisations from home.

Real-time tracking

No more waiting around, you can keep track of the progress of your files.

Access your documents

View and download all your important documents.

Manage your profile

Update your personal data yourself.

View and pay your invoices

View and pay your invoices online.

Contact me

Contact our experts and we will provide you with a quick response.