Life insurance

Life insurance to protect you and your loved ones

Protect your family’s future while optimising the taxation of your savings with our life insurance products. The key to a secure financial future!

my savings

my retirement

my family

Our SOLUTIONS

Find out more about Foyer life insurance tailored to your needs

You can’t predict what life will throw at you, but you can anticipate the risks and secure your financial future and that of your loved ones. With our life insurance policies, you can protect your family, build up your supplementary pension, save for your plans or your children, or grow your capital.

Retirement savings solutions

Supplementary pension insurance allows you to build up savings to supplement your statutory pension and maintain your purchasing power.

With horizon, you prepare for your retirement while taking advantage of stock market opportunities.

Personal protection

Personal protection insurance will protect you against what life throws at you: illness, disability or death, and ensure the payment of a lump sum or annuity to your loved ones.

If you want to protect your loved ones, your income and regularly save for your plans or children, our protect4life solution combines all three while optimising your taxes.

Investment savings

Investment insurance allows you to invest your money in order to make it grow. It will also help you build your future and that of your loved ones by ensuring the transfer of your assets with full confidence.

With our investment solutions, you can build up capital and make it grow by benefiting from stock market returns.

Do you want to optimise your taxes?

Some insurance premiums are deductible expenses that can be claimed on your tax return to reduce your tax bill.

Young professionals: which personal protection insurance is best for you?

According to the European Statistical Office Eurostat, 19.2% of 15-29 year-olds were employed in 2021. If you want to enter the world of work with peace of mind, personalised protection is essential to guard against life’s unpredictability. So, how do you insure yourself in the event of disability? Let’s discover the importance of choosing a personal protection insurance adapted to your needs as a young professional.

2 insurance policies to protect your loved ones in the event of death

Insuring the future of your loved ones also means guaranteeing that they will not be financially disadvantaged if you die. However, with the complexity of numerous insurance policies, it does not make things easy. Which ones would cover your loans? Your child’s future studies? What are the advantages of taking out life insurance in Luxembourg?

How can you ensure you are well prepared for your retirement?

What will your income be once you’ve retired? Not many people can answer this question, but it’s an important one. Retirement can be a good and long period of your life.

According to statistics, the average loss in income is 25%. You may feel this decrease might restrict your choices in life, particularly at a time when you have more time and spend more.

So what is the solution? In Luxembourg you can profit from the latest tax initiatives which allow you to save for the future (with growth) within tax efficient investment products. . It is never too late to think about your retirement to ensure you have greater financial control and remember, the earlier you prepare for your retirement, the more you will accumulate!

Foyer blog

Find all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

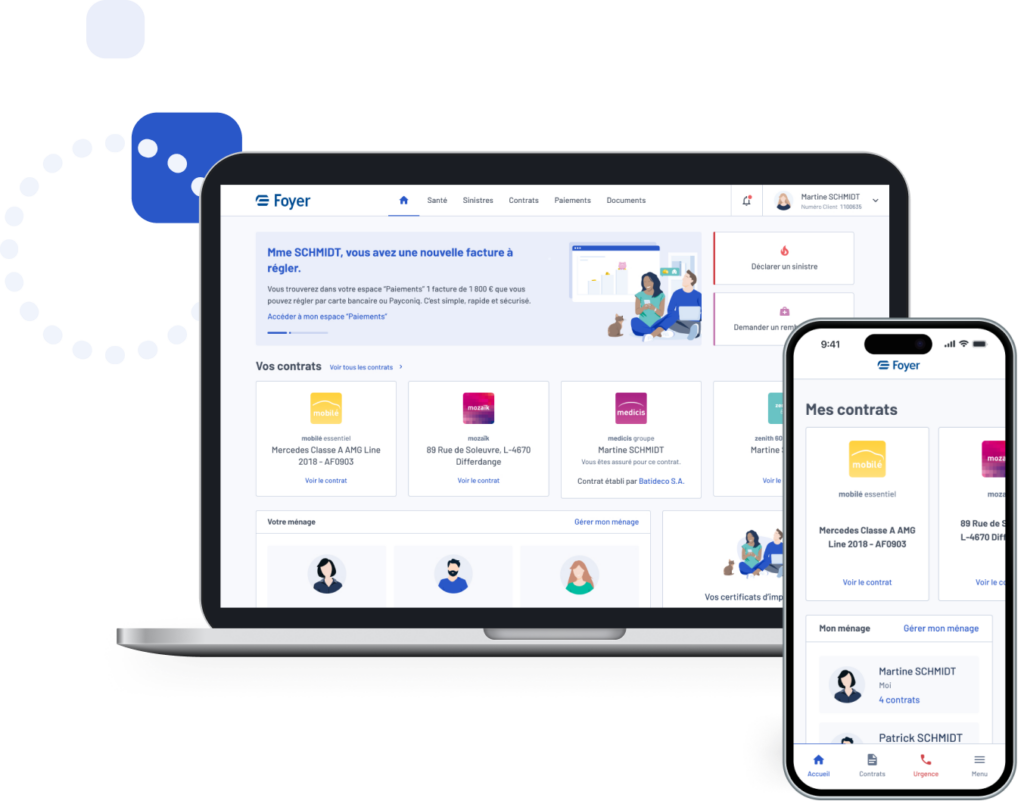

MyFoyer Client Area

In your myFoyer client area, you can view your contracts, request a tax certificate or update your personal details.

Contact me

Contact our experts and we will provide you with a quick response.